After a serene three-year bull-run in the stock market, Singapore investors were given a fright over the past week or so. The benchmark Straits Times Index (STI) fell in five of the last six sessions, including an almost 86-point -- or 3.3 percent -- fall on 15 May that was the biggest one-day points fall since the September 2001 plunge in the wake of the terrorist attack in the United States.

The latest stock market sell-off started on 11 May, and in just over a week, took the STI from 2,642.89 -- less than a percent from its all-time high attained earlier this month -- to 2,493.98 last Friday, a drop of 5.6 percent. Analysts gave several reasons for the sell-off.

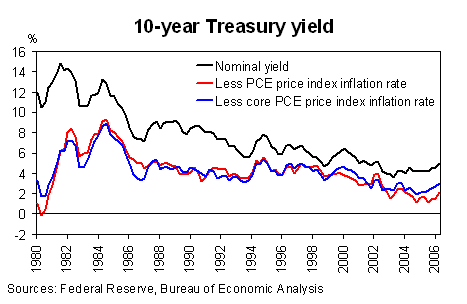

One is fear of inflation -- or to be more exact, fear of higher interest rates. This certainly was the case last Thursday, after inflation in the United States in April was reported to be higher than economists had expected, triggering fears of more rate hikes by the Federal Reserve.

Another is a weakening economy. The Singapore economy managed to perform surprisingly strongly in the first quarter, growing at an annualized 6.8 percent after a breakneck 12.5 percent growth in the fourth quarter of last year. This had prompted the Singapore government to raise its 2006 growth forecast to between 5 percent and 7 percent from between 4 percent and 6 percent.

However, Singapore's key export market, the United States, is widely expected to see its economic growth rate slow later this year as a weaker housing market becomes a drag on consumer spending. As it is, Singapore's April non-oil domestic exports disappointed economists, rising a mere 0.3 percent from the previous month on a seasonally-adjusted basis.

And it could get worse. A third fear specifically relates to declining export competitiveness arising from a stronger currency. Much like many of its Asian counterparts, the Singapore dollar has been rising for much of this year and even after some sell-down last week, trades at around S$1.58 to the US dollar, significantly stronger than around S$1.70 about six months ago.

The technical indicators are also worrying. Some analysts have pointed out that the STI broke below its 50-day moving average last week. Others are looking beyond that.

On Saturday, an article in The Business Times written by Wong Wei Kong quoted a technical analysis report by OCBC Investment Research: "On a longer-term scale, we are looking at a three-wave correction unfolding in the coming weeks. As such, we expect the 200-day moving average to be tested and broken. Our forecast for the final resting point for this three-wave correction is set between the support zone of 2,370-2,420."

Wong also quoted another report from DBS Vickers Securities on the STI: "If it breaches below 2,415, we anticipate the index to slip lower towards our target of 2,350 as the indicators are severely toppish. The recommendation for 'long' only investors is to stay out of the market for the moment, or short-sell the market as we expect another 5 per cent dive towards 2,350 levels."

Wong gave other reasons for investors to stay out of the market.

One is that it is May, so investors should go away. This alludes to the widely-held view that the six-month period starting from May is often a bad time for stocks. Furthermore, this year, May is followed in June by the World Cup in Germany, and Wong suggests that "investors may not miss much by staying away".

Incidentally, the reference to the four-yearly World Cup also highlights the fact that this is the second year in the US presidential election cycle, usually not a good time for stocks.

Another consideration that was not mentioned by Wong is that the bull run in the Singapore stock market is looking a bit long in the tooth. It has now lasted over three years, over which time the STI has more than doubled. It is said that stock prices do not go up in a straight line. However, a chart of the STI over the past three years does look like a straight line.

It is not surprising then that many analysts think that the Singapore stock market is overbought. After a run of such duration and magnitude, a correction of around 20 percent or more is quite normal for the Singapore market. Such a correction would bring the STI down to about 2,100. That makes the downside targets from OCBC and DBS look rather tame in comparison.

Not all factors point towards bearishness though. Despite the run-up over the past three years, strong earnings growth over the period means that valuations are not as stretched as is often the case at this point in the cycle. Wong cites a UBS Investment Research report saying that the Singapore market now trades at 15.4 times earnings, lower than the five-year mean of 16 times and the 10-year mean of 18 times.

Nevertheless, mounting market nervousness appears to be a global phenomenon. Singapore stocks were not the only ones that suffered in the recent sell-off. Most markets around the world fell as well.

Indeed, Merrill Lynch's May survey of global fund managers shows that many of the concerns affecting the Singapore market -- higher inflation, higher interest rates, lower growth -- applies globally as well. The survey found a decline in risk appetite among managers, with many shortening their investment time horizon and increasing their cash holdings.

And market unease is not limited to stocks. Commodity prices have fallen too on the same fears of higher interest rates and slower growth in demand.

The Singapore stock market is obviously just one victim of this global investor nervousness. If the nervousness persists, the Singapore stock market is unlikely to be spared.

Investor psychology can be very fickle though. Despite the concerns mentioned above, the recent turn towards greater investor nervousness and market volatility may not persist. And even if it does, seasoned investors with longer investment time horizons could conceivably ride out the volatility with relatively little harm to their long-term financial, physical or psychological health.

However, for investors who do not have the stomach for high risk and market volatility, selling in May and going away -- perhaps to watch the World Cup in Germany -- might not be a bad idea.